Affiliate Economics: How Vavada Structures Commissions Across Eastern Europe

By Neil Sculthorpe, Senior Lecturer in Computer Science, Nottingham Trent University

Affiliate systems are the financial backbone of nearly all online gambling platforms — and Vavada is no exception. Over the last decade, we’ve witnessed the evolution of these systems from basic referral links to complex, performance-based hierarchies with multilayered incentives.

In this article, I unpack the commission structure used by Vavada in various Eastern European markets, explore its underlying mathematical model, and analyze how such models scale from an academic standpoint.

1. The Vavada Affiliate Program in a Nutshell

Vavada’s affiliate model operates on a typical RevShare + Hybrid CPA structure:

- RevShare: Partners earn 30–45% of net gaming revenue (NGR) per user

- Hybrid: A fixed CPA (cost per acquisition) of $40–$80 is added once a user deposits

- Negative carryover: Not always applied, depending on partner rank

This model incentivizes long-term player engagement while also providing immediate payouts for high-volume traffic.

2. Regional Breakdown: Bulgaria, Romania, Ukraine

Through conversations with local affiliates and examination of offer listings, we observe:

| Country | CPA | RevShare % | Min. Player Deposit |

|---|---|---|---|

| Bulgaria | $70 | 40% | $10 |

| Romania | $65 | 35% | $10 |

| Ukraine | $50 | 30% | $5 |

Bulgarian traffic appears to be among the most valued due to higher LTV (lifetime value) and lower fraud risk. Ukraine, though cheaper, has high conversion volatility.

3. Commission Math: How Partners Profit

Assuming an average player deposits $50 and generates $300 in NGR over 3 months:

- At 40% RevShare, the partner earns $120 per player

- With hybrid CPA + RevShare, total payout = $70 (CPA) + $120 = $190

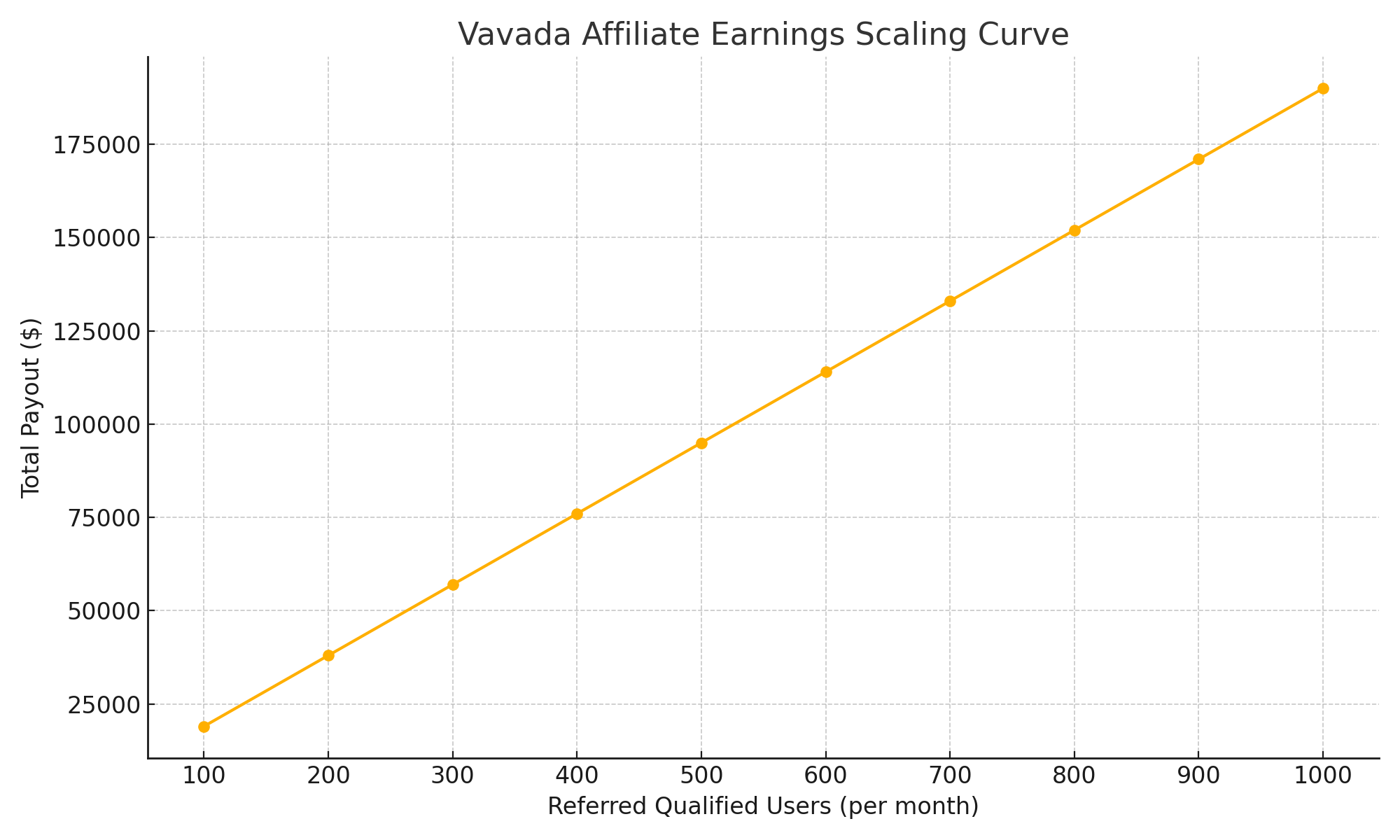

For high-volume affiliates driving ~1,000 qualified users/month, this scales to $190,000/month gross. But this is idealized; real earnings vary due to refund policies, fraud deductions, and chargebacks.

4. Multi-Level Commissions and Downline Structures

Some Vavada affiliates also benefit from “downline” earnings — a form of tiered structure where you receive a cut from sub-affiliates’ performance (usually 5–10%). This resembles MLM models and adds scalability, though also complexity.

From a systems design perspective, it introduces a network graph of incentives that must be carefully audited for abuse prevention and payout throttling. Graph theory tools (e.g., edge-weighted directed trees) could help model payout flows and potential fraud loops.

Vavada’s affiliate strategy in Eastern Europe reflects a pragmatic blend of high incentives and localized flexibility. For data scientists, it offers a playground for modeling churn, forecasting revenue, and optimizing acquisition channels.

In the next article, I’ll explore the front-end UX of casino platforms: how minor layout choices affect user retention and click heatmaps — with examples from Vavada’s mobile interface.